-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

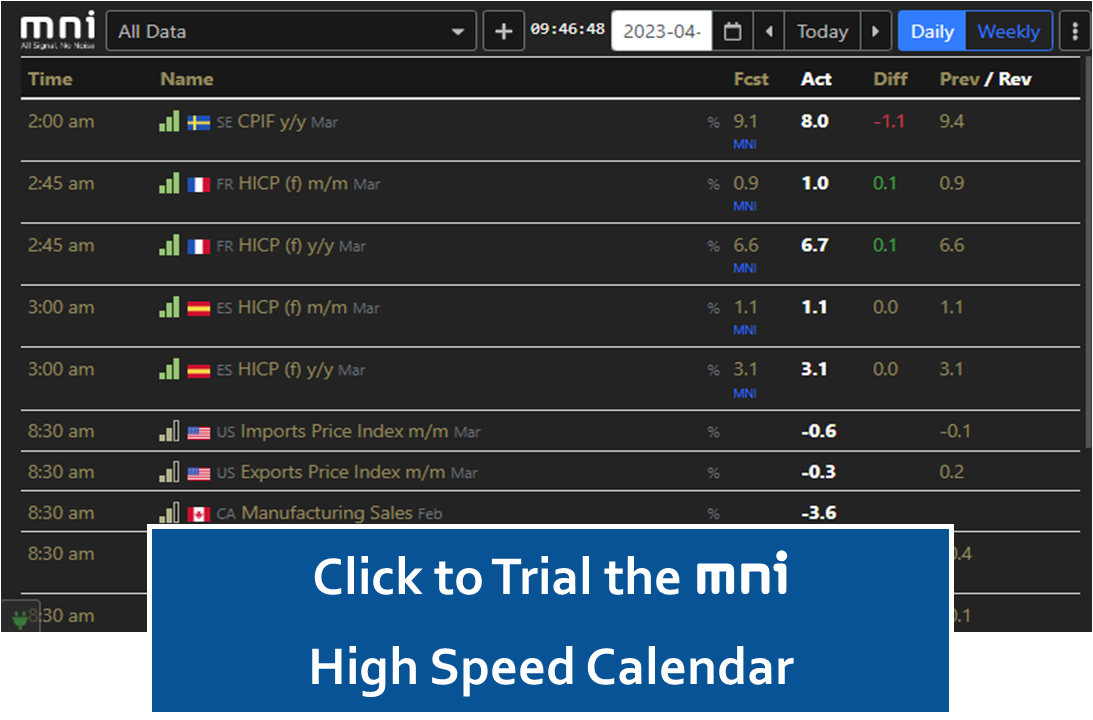

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

MNI INTERVIEW: Hungary Needs More Growth For Fiscal Target

MNI NBH Preview - May 2024: New Phase of Policy Continues

The National Bank of Hungary is expected to cut the base rate by 50bps to 7.25%.

MNI POLICY: NBH Set For Second 50Bp Cut, H2 Outlook Less Clear

Hungarian central bank slowed its pace of easing from 75bps in April, and looks like hitting its 6.50-7.00% base rate target by mid-year as planned.

MNI: Fed Considering Discount Window Readiness Rule - Barr

Improving the functionality of the discount window would help address lessons about liquidity learned last spring, Fed regulator says.

Sweden Macro Signal - May 2024: Recovery In Sight

“Green shoots” are beginning to emerge in the Swedish economy, supported by easing policy rates, improving sentiment and positive real wage growth.

ICC Decision On Israel Could Jeopardize Ceasefire Deal - Blinken

US President Joe Biden and US Secretary of State Antony Blinken have criticised today's announcement that ICC prosecutors are pursuing arrest warrants against leaders from Israel - Prime Minister Benjamin Netanyahu and Defence Minister Yoav Gallant - and leaders of Hamas - Ismail Haniyeh, Yahya Sinwar, and Mohammed Deif - for alleged crimes during in the war in Gaza and the Hamas attack on October 7, 2023.

- Biden said in a statement: “The ICC prosecutor’s application for arrest warrants against Israeli leaders is outrageous. And let me be clear: whatever this prosecutor might imply, there is no equivalence — none — between Israel and Hamas. We will always stand with Israel against threats to its security.”

- Blinken said in a statement that the US, "rejects" the ICC announcement and said the equivalence of Israel with Hamas is "shameful." Adds that an ICC decision in favour of the prosecution could "jeopardize efforts on a hostage deal/ceasefire in Gaza."

- Blinken also notes that the, "ICC Prosecutor [Karim Khan] himself was scheduled to visit Israel as early as next week to discuss the investigation and hear from the Israeli Government," however the prosecutor failed to attend scheduled meetings and, "went on cable television to announce the charges." Blinken says: "These and other circumstances call into question the legitimacy and credibility of this investigation."

- Barak Ravid at Axios notes: "A panel of judges will now examine Khan's request and decide whether to issue the warrants." More on the warrant discussed in previous bullet here.

MNI Interview With Head of Hungary's State Audit Office

- MNI interviews the head of Hungary's state audit office -- On MNI Policy MainWire now, for more details please contact sales@marketnews.com

House Of Reps To Consider Two Crypto Bills This Week

The House of Representatives will consider two pieces of legislation this week which could bolster the crypto industry. The first, H.R. 4763, would take some regulatory powers away from the Securities and Exchange Commission by reclassifying crypto as a commodity rather than a security. The second, H.R. 5403, would bar the Federal Reserve from issuing its own digital currency.

- Bloomberg notes: "SEC Chairman Gary Gensler has said almost all crypto tokens are securities. During his tenure, the SEC has levied a slew of enforcement actions against crypto firms for issuing or allowing users to trade unregistered securities."

- Ranking Democrat of the Financial Services Committee, Rep Maxine Waters (D-CA), said “there is simply no good reason to throw all of that away [longstanding financial regulation] in favor of a complicated new framework that caters to a single industry that refuses to follow the rules."

- Democrats said in the committee report: “By shifting a substantial portion of the digital assets market to the commodities regime, the bill removes several critical protections that apply to securities and not commodities.”

- Politico notes: “Watch closely to see whether House Democratic leaders whip against these: The backdrop is growing Democratic dismay with the Biden administration’s tough-on-crypto stance, which could pave the path for industry friendly regulation if Trump wins in November.”

All of the gilts sold in the 15-year area

- All of the sales around the 15-year area with GBP642.2mln of the 4.75% Dec-38 gilt and GBP107.8mln of the 1.125% Jan-39 gilt sold.

- There were also a lot of offers for the 4.25% Mar-36 gilt (the GBP906mln a larger size than the total amount sold across all medium gilts today) - but the BOE didn't accept any of the offers for this gilt.

- Note, gilt futures fell around 15 ticks going into the bidding deadline (the 5 mins before) - but that move has all been revered so we trade back at 97.70 at writing.

MNI REAL-TIME COVERAGE

Wells Fargo Expect 75bp Cut This Week, Before BCCh Turns More Cautious

Timely & Actionable Insight on Central Bank Policy

Timely & Actionable Insight on FX & FI Markets

Timely & Actionable Insight on Emerging Markets

Sample MNI

MNI NEWSLETTERS

MNI US MARKETS ANALYSIS: New All-Time Highs For Gold

MNI DAILY TECHNICAL ANALYSIS - Gold Trend Structure Remains Bullish

MNI US OPEN: Markets Generally Look Through Latest Geopolitical Threat

MNI EUROPEAN MARKETS ANALYSIS: Crude Little Changed Today Despite Geopolitical Events

MNI EUROPEAN OPEN: Gold Hits Fresh Record Highs

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.